DeHive Stables

How to Benefit from Stablecoin Staking With DeHive Stables?

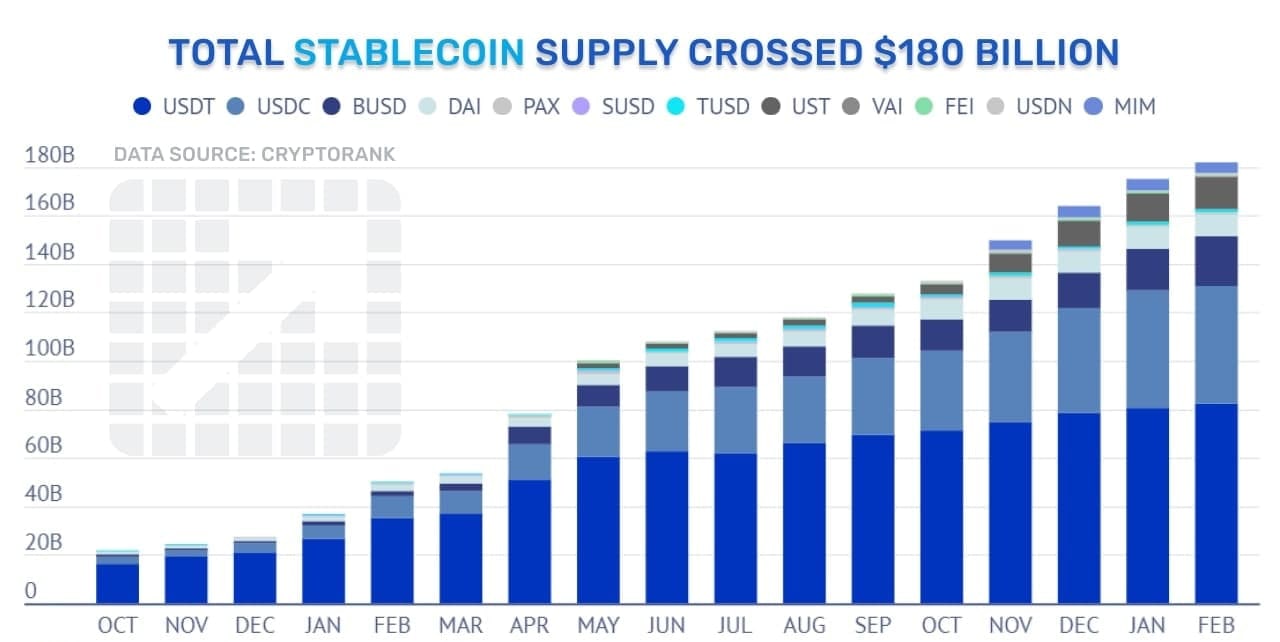

During the hard times of market decline and overall geopolitical uncertainty, many traders lose profits. Now more than ever, they start seeking alternative investment tools and strategies that would help them stay on a roll. One of such instruments is stablecoins, whose price is pegged to stable assets and doesn’t fluctuate much. You’ve definitely heard of them or might even have some in your wallet – these are USDT, USDC, DAI, BUSD, etc.So how exactly can you earn interest on stablecoins, and what tools should you use?

Source: CointelegraphWhat is more, you can also earn interest on stablecoins, thus getting a permanent, stable profit regardless of the overall situation in the cryptocurrency market. One of the instruments that allow you to earn on stablecoins is DeHive Stables. Let us tell you more about it.

Source: CointelegraphWhat is more, you can also earn interest on stablecoins, thus getting a permanent, stable profit regardless of the overall situation in the cryptocurrency market. One of the instruments that allow you to earn on stablecoins is DeHive Stables. Let us tell you more about it.

With DeHive Stables, you can benefit in several ways:

In the case of the Stable Impulses, the process is a bit more complicated since it requires you to entrust your LP tokens to DeHive smart contract. Still, you can complete it and start getting automatic compound interest in a few minutes.

In the case of the Stable Impulses, the process is a bit more complicated since it requires you to entrust your LP tokens to DeHive smart contract. Still, you can complete it and start getting automatic compound interest in a few minutes.

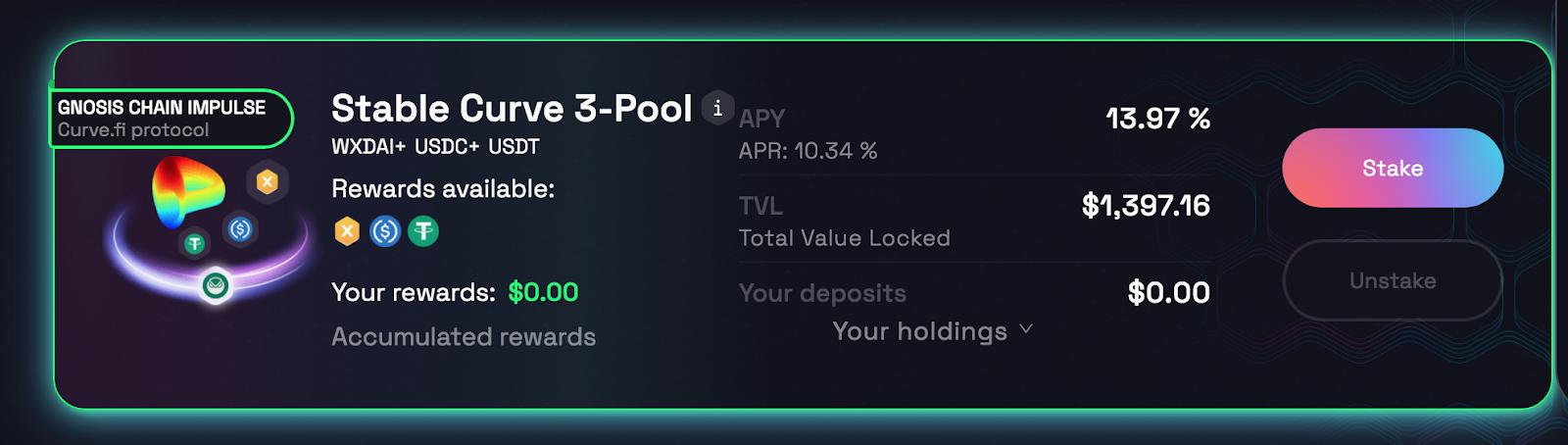

The regular stablecoin APY on the DeHive platform is around 5-13%. For instance, this is the performance of the Stable Curve 3-Pool on the Gnosis chain as of March 14, 2022. You can make sure of the numbers and check the tools on the DeHive platform even before connecting your wallet – it’s fully transparent.

For instance, this is the performance of the Stable Curve 3-Pool on the Gnosis chain as of March 14, 2022. You can make sure of the numbers and check the tools on the DeHive platform even before connecting your wallet – it’s fully transparent.

Benefits of stablecoins

Being pegged to external assets like gold or the US dollar, stablecoins can be pretty beneficial for any trader, especially during the market recession.The main killing feature of such assets is their low volatility compared to other cryptocurrencies. The stablecoins fluctuation rate does not exceed 1%, making stablecoin price prediction extremely easy.Thus, the main benefits of stablecoins include:- Low volatility. Stablecoins live up to their name and remain “stable”, compared to other cryptocurrencies, which means their price does not fluctuate much.

- High security. Like any other crypto, stablecoins are secure and transparent. Besides, as they are pegged 1:1 to real-life stable assets, they are safe to invest.

- High liquidity. Stablecoins retain high liquidity at all times, which means users can enter and exit the trade at any moment on any platform.

- Decentralized nature. Compared to regular assets in the traditional financial system, stablecoins are decentralized, which allows them to get all the advantages of crypto – low fees, security, anonymity, etc.

What are DeHive Stables?

DeHive Stables are stable Defi tools that help you earn a yield on stable coins.For now, the DeHive team has created three stablecoin instruments – all of them are auto-compounding pools based on the Impulse technology and with one-click design. They enable automatic compound interest on stablecoin staking.With DeHive Stables, you can benefit in several ways:

- Receive stable passive income even during high market fluctuations and recession because of simple trading fees accumulation from the target pool.

- Get automatic compound interest on staking your stablecoins – all with just one button.

- Optimize your returns on stablecoins and get stable profit at all times.

How do Stables work?

The initial idea behind Stables was to make them as easy to use as possible, which allowed us to shorten the stablecoin yield farming process to three simple steps.How much profit can you get?

There is no such thing as the best stablecoin interest rate, otherwise, we would offer it. However, due to the enabled auto-compounding, DeHive Stables offer optimal returns on stablecoins and help you maximize your profit even at times of market recession.The regular stablecoin APY on the DeHive platform is around 5-13%.

Conclusion

In the modern world, having some stability is a true luxury, especially when it comes to cryptocurrency. Fortunately, with stablecoins, you can protect your investments and predict your income at all times.DeHive Stables are one of the few instruments that enable stablecoin farming and help you optimize returns and get maximum profit with minimum effort. Stake your stablecoins on DeHive and start getting profit today!

Data provided by Coingecko

Data provided by Coingecko